Mr. Luis Arredondo Malo

Chairman

Once again, on the publication of our Annual Report, I would like to express my gratitude for your support and confidence.

During 2023, the Company has reached a turning point, marked by the start of the portfolio turnover and a significant increase in rental income. The Group’s robust financial position and potential for value creation enable us to respond to the demand for quality space and to make good progress with ongoing refurbishment projects, despite the market impact on valuations.

Regarding sustainability, these past months have also been of special relevance: we have achieved a high number of asset certifications and significant energy savings thanks to the efficiency improvements carried out in the portfolio.

This report presents Árima’s advances and performance, with the objective of sharing in the clearest and most transparent way possible the initiatives carried out and their impact on the Company and all its stakeholders.

We will continue on this path, always supported by our team, our strong corporate values and the trust you place in us.

Yours faithfully.

+Mr. Luis López de Herrera-Oria

Chief Executive Officer and Vice-Chairman of the Board of Directors

May I begin by extending my sincere thanks to our Chairman, as well as the members of the Board for their invaluable support and collaboration during these months. Most especially, i would like to thank our shareholders and everyone who continues to show their confidence in our project.

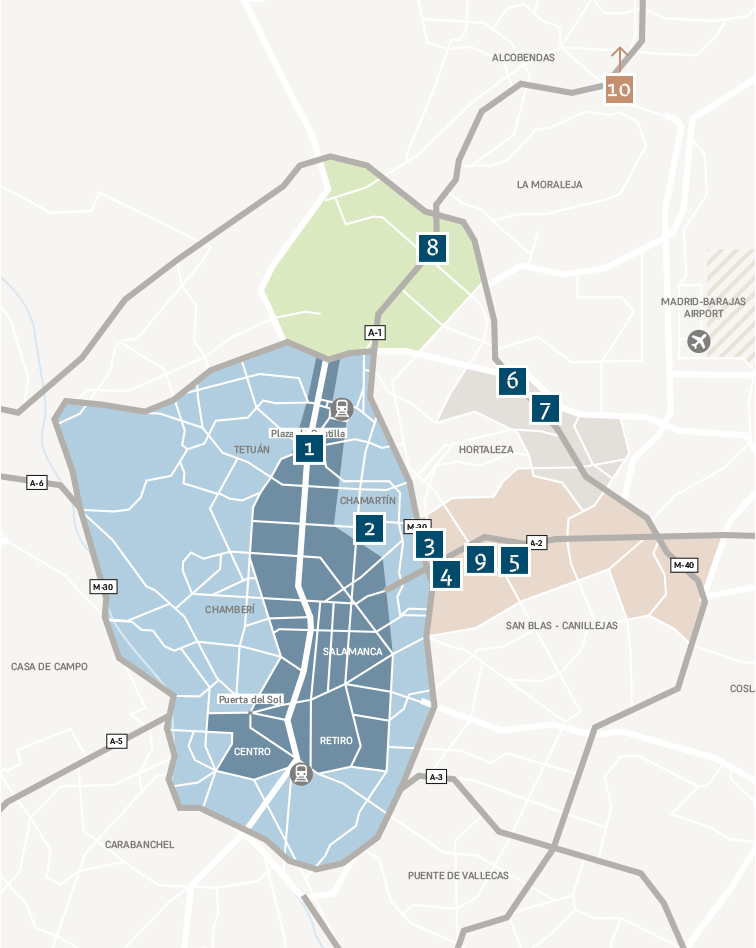

Thanks to your support and the professionalism of the team, this year the Company has crystallised the value from completed projects and acquired new, well-located value-add opportunities. With the sale of the María de Molina office space, we divested a stabilised asset after a successful refurbishment. This transaction is complemented by the purchase of an office building in Madrid, with significant reversion potential, for a value of EUR 29.75 million and a promise to purchase agreement for the acquisition of another property for EUR 15.3 million. This asset rotation demonstrates that our value creation strategy remains solid, with an expected growth of the portfolio’s gross income.

The demand for quality office space remains strong, with 10,500 sqm of leases signed, resulting in an increase in occupancy of +810 bps in comparable terms and an additional EUR 2.5 million in annual rents. Refurbishment projects continue to progress, covering 25,000 sqm at year-end, which guarantees further rental growth potential.

The year 2023 was undoubtedly marked by the evolution of the market, as the yield expansion impacted the value of the assets. Despite this, our portfolio was valued at €359 million at year-end, resulting in an EPRA NTA of €11.3/share.

Árima’s financial position remains strong, with a net loan to value of 19.2% and net all-in costs of 2.0% ensuring significant financial flexibility.

Our proven experience and your invaluable trust help us guarantee your capital investments, thanks to the certifications awarded by the prestigious institutions LEED, BREEAM and WELL which recognise our sustainable management.

My warmest regards to you all.

+

ENVIRONMENTAL

ENVIRONMENTAL

SOCIAL

SOCIAL

CORPORATE GEVERNANCE

CORPORATE GEVERNANCE

ECONOMIC

ECONOMIC

INVESTORS

INVESTORS  EMPLOYEES AND

EMPLOYEES AND  SUPPLIERS AND Y

SUPPLIERS AND Y TENANTS

TENANTS

LOCAL

LOCAL